Should the Mix of OTA Room Nights Be…?

What Should the Mix of OTA Room Nights Be…?*

Response to the battle cry “lower the OTA percentage of room night mix” may reduce EBITDA.

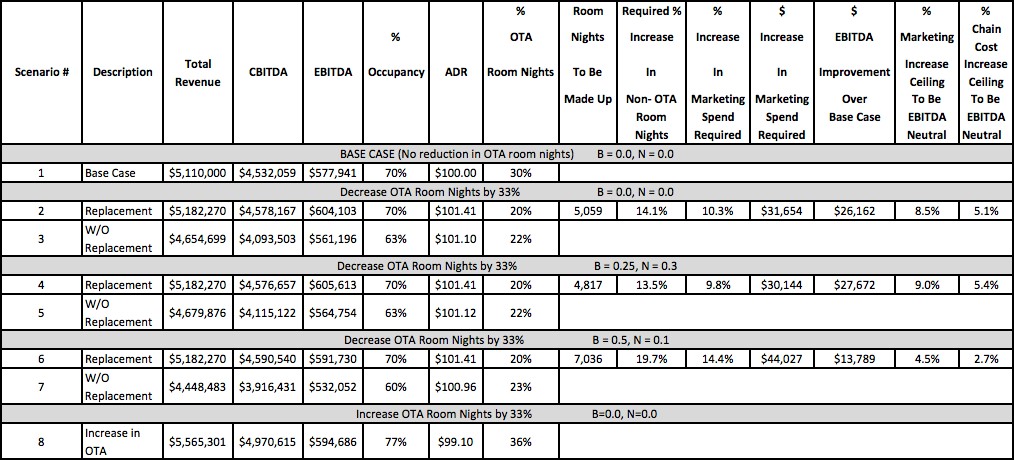

Ultimately, improving EBITDA through shifts in channel mix is based on a holistic analysis and execution of total integrated channel mix strategy over time. The shift must be augmented with sales and marketing actions and associated costs to achieve it and sustain EBITDA. To illustrate this point, we developed a simple EBITDA impact model for OTA and non-OTA channel mix shifts. The model is based on a 200-room, limited-service property with 70% occupancy and aggregate ADR of $100.

A simplistic (and potentially misleading) evaluation of decreased OTA room night mix impact is a reduction in OTA room nights (e.g., 1/3) replaced with non-OTA room nights. This evaluation predicts a substantial (e.g., a 10%) increase in EBITDA. Missing from the evaluation is how much it may cost to replace foregone OTA room nights with non-OTA room nights to sustain occupancy. And, can the shift be achieved with positive EBITDA improvement, given increases in marketing and sales expense to achieve it? In effect, some or all foregone OTA bookings must be replaced and there is some EBITDA neutral upper threshold sales and marketing expense level (e.g., 17%) to achieve it.

The answer to that question is complicated in general and even more complex for any one property. It is also complicated by the interplay of property-level billboard and dilution effects.

The billboard effect is the impact display in OTA sites has on driving incremental transactions through hotel direct channels such as the reservation center and the brand website by being displayed, but not booked, in OTA websites. In effect, the prominent presence in OTA display acts like a search engine, where the consumer views the OTA site but ultimately books directly with the property. There is ample published research to suggest that there is such an effect**. The dilution effect is the diversion of transactions from a property that would have been booked through hotel direct channels but instead are booked in OTA channels.

We developed an EBITDA model to evaluate the interplay of various possible billboard and dilution levels effects to illustrate how those impacts change the results for various levels of increase and decrease in the mix of OTA transactions. To illustrate this point, we developed a simple EBITDA impact model for OTA and non-OTA channel mix shifts. The model is based on a 200-room, limited-service property with 70% occupancy and aggregate ADR of $100.

See the table below for impacts of a 1/3 reduction and increase of OTA room night mix on EBITA, sales and marketing expenses and chain costs, (i.e., to achieve EBITA neutrality) when various billboard and dilution effects where present. For example, the model showed that:

- The number and percentage increase in non-OTA room nights can be much greater with, for example, a 33% reduction in OTA room nights when a property-level billboard effect is substantial (e.g., one non-OTA booking for every two OTA bookings foregone) and even greater with a relatively low dilution effect (e.g., 10% increase in non-OTA diluted room nights for each foregone OTA room night). Depending on values for these effects, a required level of non-OTA room night replacement can be substantial (e.g., nearly 40% greater). As well, the EBITDA neutral threshold percentage level for increased marketing and sales expense growth can be much lower (e.g., 4.5% versus 8.5%) before EBITDA gains would be fully offset.

- A major EBITDA loss risks exist if there is a substantial billboard effect relative to a dilution effect and foregone OTA room nights are not replaced. In this case, the impact on EBITDA can be substantial and negative (e.g., an 8% percent reduction).

- Alternatively, that same 33% reduction in OTA room nights could be achieved with a slightly larger increase in non-OTA bookings (e.g., 13.5% versus 19.7%) and with a much higher EBITDA neutral threshold for a marketing and sales expense (e.g., 9.0% versus 4.5%), if the billboard effect was slight (e.g., one non-OTA booking lost for 4 OTA bookings foregone) and the dilution effect was significant (e.g., a 30%increase in bookings made direct for each OTA booking foregone).

Interestingly, that same analysis could be applied to evaluate the EBITDA effect of increasing the mix of OTA room nights. For example, in the appendix, we show that if there were no billboard or dilution effects, increasing the mix of OTA bookings could increase EBITDA by 2.9%.

For chain properties, there is another dimension of this type of analysis. Are there additional costs, direct or opportunity for chain-level efforts to reduce OTA room night mix? And, do these costs offset potential EBITDA gains for the property? The direct cost might include chain imposed assessments for that purpose. Opportunity costs might include the shift of chain expenditures and/or investments to support the shift that might have had a more effective impact on property level EBITDA. These might include, for example, the diversion of general promotional advertising and marketing expenditures to spending a mix change (book direct) campaign.

There can, of course, be a whole series of potential values for billboard and dilution effects (and the means to measure them) for a property and for specific circumstances such as quality classification, occupancy, ADR, channel mix, seasonality and so forth. So, measuring them can be difficult and further complicated by the fact that the impact magnitudes are likely non-linear based on the OTA room night contribution percentages and changes thereto. (NOTE: The model does allow sensitivity testing of such values on EBITDA. We selected a few values for illustration purposes.) Despite the difficulty, the impacts of these effects on EBITDA are significant. Therefore, owners and managers would be wise to evaluate the possible outcomes of their efforts to change the distribution of OTA room nights even if they employ some sensitivity testing of their values.

The practical implications are that changing the mix of OTA room nights requires a plan to replace them with non-OTA room nights and a need to know (or estimate) EBITDA-neutral threshold levels for sales and marketing costs needed to achieve the mix change. Moreover, including an analysis of the potential interplay of possible billboard and dilution impacts would be advised.

A dilemma for owners and managers is how to measure (or accurately estimate) property-specific billboard and dilution effects. One approach is to do sensitivity testing for such values (as illustrated in the model) and cautiously change channel mix over time while observing impacts on OTA and non-OTA mix, EBITDA and marketing and sales expenses. Another is to perform some A/B testing of increases and decreases in OTA participation to observe impacts on non-OTA bookings and EBITDA.

As well, asset managers might implement some operational means to observe over time patterns in guest channel booking behavior related to OTA participation, for example:

- When checking in guests, ask if they have stayed at the property before and their primary channel source(s) for choosing the property. Do the same if they have not. If possible capture their email address. In all cases, track guests’ booking channels (or do so by relating rate codes used to channels). If they used an OTA channel, ask if they would be likely to use it again or book direct. Then track over time.

- During guests’ stays solicit feedback on satisfaction and possible actions to improve their experiences. Better yet, use past stay experiences (e.g., through a customer relationship management system (CRM)), to take actions likely to improve guest satisfaction. At a minimum, resolve guest issues ideally in real time. Finally, celebrate successes and resolve mistakes over time; better yet, ask guests to do so as well, ideally via social media.

- At check out and post stay solicit information about stay satisfaction and ask if they would be likely to book directly in the future. Better yet, capture their e-mail address in exchange for some future value for the next stay(s).

If all this sounds like effective asset management, it is. Many successful property managers and owners are already doing this and have discovered many other ways to improve guest satisfaction and financial performance. What is different is the discipline to connect such actions (and guest reactions) with channel choices and guest stay frequency. Capturing this supports the assignment of economic values to reduced channel costs and/or increased guest stay frequency. The bottom line is for asset managers to practice effective CRM, measure its impact, celebrate its success, address its failures and encourage guests to do the same via social media.

Owners need to estimate the value of such actions on EBITDA as a guide to resource allocation for asset value growth.

* This model was developed and presented at the Cornell Center for Hospitality Research Summit, October 2017. Contact the authors Bill Carroll, Ph.D. wjc28@cornell.edu and Trevor Stuart-Hill trevor@revenuematters.com for more information about the model and the presentation.

** See CK Anderson, “The Billboard Effect: Online Travel Agent Impact on Non-OTA Reservation Volume,”

Cornell Center for Hospitality Research Report, 2009; CK Anderson, “Search, OTAs, and Online Booking: An

Expanded Analysis of the Billboard Effect,” Cornell Center for Hospitality Research Report, 2011.

ESTIMATED IMPACT ON REPLACEMENT (AND NON-REPLACEMENT) OF OTA ROOM NIGHTS ON EBITDA GIVEN MARKETING SPEND AND CHAIN COSTS

About the author

Bill Carroll is actively engaged with hotel ownership groups, intermediaries and start ups in the areas of digital media management, pricing, and marketing. He is capable of taking a holistic view of marketing, pricing, distribution and revenue management for hospitality related firms. He helps clients chart a successful courses of action through improved strategic focus, organizational change and systems solutions choices. Bill is a Consulting Member of Cayuga Hospitality Consultants and a senior analyst with Phocuswright.

Contact Us