To Save Lots of Money ($$$) in Federal & State Income Taxes You need an Appraisal/Valuation/Cost Segregation Team!

As Sophisticated Lodging Professionals, you know the Tax Savings strategy and benefits of a Quality Cost Segregation Study. You know, and understand, that a Quality Cost Segregation Study looks at all Commercial Non-Residential 39-Year Property, and all Commercial Residential 27.5-Year Property, and reclassifies a percentage (%) of that Property away from long-lived 27.5 & 39-year Tax Depreciable Property to short-lived 5, 7 & 15-year Tax Depreciable Property.

You know the three major benefits of a Quality Cost Segregation Study:

1)You don’t know if we will own our Commercial Property in 27.5 or 39-years from now, but we know you own the Property today, so you want to maximize your Federal and State Income Tax Savings ($) today!

2)You would rather receive a larger Federal and State Income Tax Savings ($) today, when the Dollar ($) has the buying power of a Dollar ($), and not in the future, when the Dollar ($) is depreciated and eroded by inflation!

3)You want to take advantage of the Re-Investment Opportunity Horizon. The ability to reinvest, into your businesses, the Tax Savings ($) realized with the use of a Quality Cost Segregation Study, reinvesting those Dollars ($) into your business, employees, services and future real property improvements and acquisitions!

The problem with using a Cost Segregation Professional alone!

Cost Segregation Professionals, who do not have an Appraisal/Valuation back-ground, lack the knowledge, expertise and in many cases the state licensing need to properly value and allocate all acquired Property into their proper tax lives (5, 7, 15, 27.5 & 39-year). This inability to identify, classify, and value all short and long-lived property acquired in a Lodging Acquisition is a flawed strategy that will cost you in missed Tax Savings ($).

Cost Segregation Professionals are not Appraisers/Valuation Professionals! They do not Opine on Value! There expertise is limited to:

1)Real Property analysis

2)Calculating ‘Replacement Cost New less Depreciation’ not ‘Value’.

This limited scope of knowledge, by the Cost Segregation Professional, without the support of Appraisal/Valuation Professionals will limit Your Federal & State Income Tax Saving ($) significantly.

We will demonstrate (below) that Cost Segregation Professionals, though they can provide significant tax savings, are limited in the identification and tax savings ($) they can offer, without the support of Appraisal/Valuation Professionals

Examples:

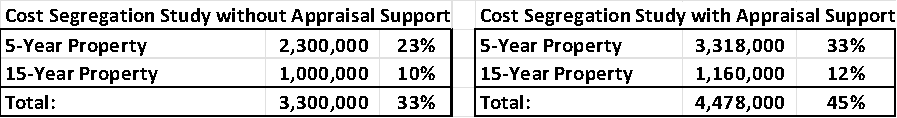

Cost Segregation Study without the support of Appraisal/Valuation Professionals:

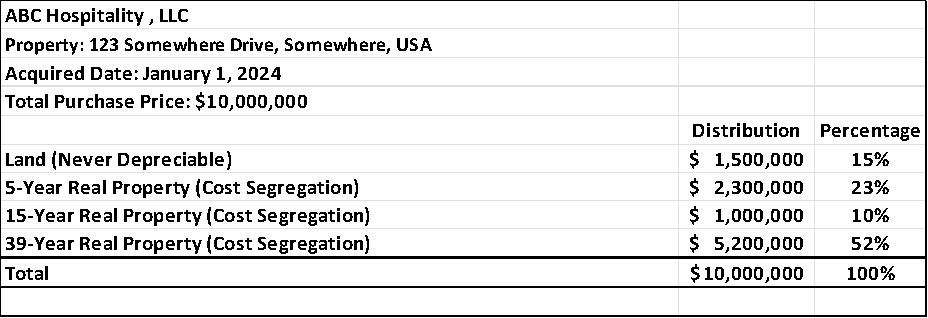

Our Cost Segregation Professional is hired to conduct a Cost Segregation Study and is provided with three pieces of information by the new owners of the Property: ABC Hospitality, LLC.

1)Address of Property: 123 Somewhere Drive, Somewhere, USA

2)Purchase Price: $10,000,000

3)Acquired Date: January 1, 2024.

Our Cost Segregation Professional, without an Appraisal/Valuation support team, makes a common assumption that the under-lying land value is 15% of the total acquisition value of $10,000,000 ($1,500,000). A number ($) that is not supportable if it were to come under audit by the In-House Accounting Team, Your CPA Team, or the Internal Revenue Service (IRS)!

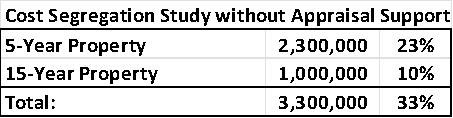

A Cost Segregation Study without Appraisal/Valuation Team Support:

A nice reallocation of Property from Long-Lived to Short-Lived Property: $3,300,000.

Cost Segregation Study with the support of Appraisal/Valuation Professionals:

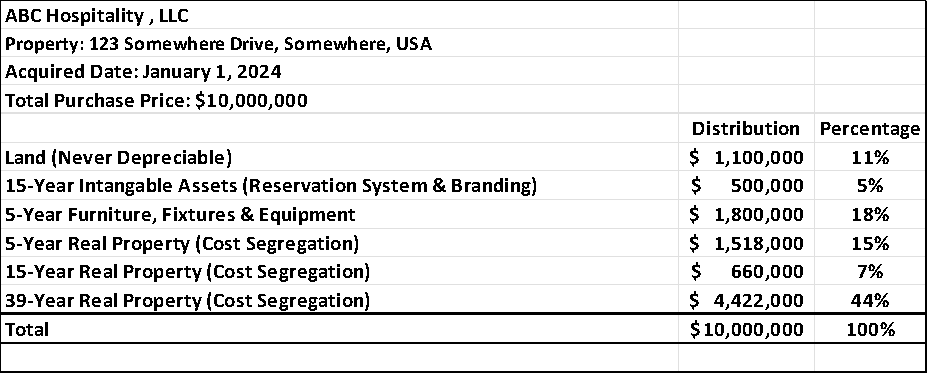

Now, let’s see what happens with our team consisting of Appraisal/Valuation Professionals and our Cost Segregation Professional work together on the same project.

Given the same information from the Client:

1)Address of Property: 123 Somewhere Drive, Somewhere, USA

2)Purchase Price: $10,000,000

3)Acquired Date: January 1, 2024.

Our Team of Valuation/Appraisal Professionals and Cost Segregation Professionals have decided that Four Professionals will be needed for this assignment:

1)Real Property Appraiser to value the Underlying Land Value.

2)A Business Valuation Appraiser to value the Reservation System and Branding (Intangibles).

3)Furniture Fixtures & Equipment Appraiser to value the Furniture & Equipment on site.

4)Cost Segregation Professional to identify, and capture, all 5, 15 & 39-year Real Property.

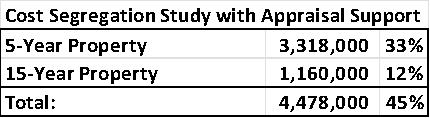

A Cost Segregation Study with Appraisal/Valuation Support:

A better reallocation of Property from Long-Lived to Short-Lived Property: $4,478,000.

This Appraisal/Valuation/Cost Segregation Professional Tax Strategy is superior to Cost Segregation Services provided in isolation for the following reasons:

1)It provides a true, and accurate, Land Value conclusion that is supportable to the Internal Revenue Service! Many times, this value conclusion is lower than the ‘non-supportable estimate’, assigned by the Cost Segregation Professional!

2)Our study accounts for, and Values, all ‘Intangible Property’ that a Cost Segregation Professional is not trained to identify and value!

3)Our study accounts for, and Values, all ‘Furniture, Fixtures & Equipment’ that a Cost Segregation Professional is not trained to identify and value!

4)Our study provides a more detailed conclusion, and asset breakout, which allows for its use in Purchase Price Allocation filings (ASC-805) and for posting on your company’s Fixed Asset Record System.

Conclusions

The conclusions provided by our Appraisal/Valuation/Cost Segregation Team will provide added Tax Savings ($), an Audit Supportable Study, and A Multi-Use Study that can be used for Purchase Price Allocation Studies (ASC-805), Fixed Asset Record System Reporting, Repair Regulation Compliance, and a whole host of other accounting and tax needs.

Our Appraisal/Valuation Team can also provide Fine Jewelry, Fine Art, Fine Furniture, Aeronautic and Marine Appraisal/Valuation Services when needed for any assignment.

About the author

Walter O’Connell, Managing Director of Hotel Valuation & Cost Segregation Services, LLC (HVCSS) and a consultant at Cayuga Hospitality Consultants. Responsible for a variety of valuation services which include the valuation of tangible assets for purchase price allocation, financing, tax depreciation, insurance, and cost segregation studies. Walt has extensive experience in Furniture, Fixture & Equipment valuation (FF&E) and Cost Segregation Studies within the hospitality industry. Walter holds a Bachelor of Arts degree in Economics and Bachelor of Science degree in Finance from Kean University of New Jersey and a Master of Arts degree in Economics from Montclair State University of New Jersey. Walt continues to strengthen his credentialing by not only taking, but also teaching, technical courses in the fields of Personal Property Valuation and Cost Segregation.

Contact Us