The Trifecta of Lodging Acquisition Studies

Congratulations! You have acquired a new Lodging Property. After months, or years, of due diligence, you have finally closed on your newly acquired Lodging Property.

During the due diligence process, and calculating the bid price ($), it is likely your Acquisition Team focused on assts, liabilities, capital, room type, room count, room rates, length of stay and occupancy rates. In order to project out the proper offering price ($), you calculated additional ‘future revenue,’ based on such factors as: increased revenue from new ownership, new management, new furnishings, food & beverage modifications and/or rebranding. More times than not, a complete valuation of the Property is not performed during the due diligence process of the acquisition, relying on an ‘accounting review’ of the balance sheet and current/projected revenues from planned improvements by ownership and management.

Now that the acquisition has been completed, the in-house accountants / public accountants must now begin to set-up the Fixed-Asset-Record (‘FAR’). Simply put, the FAR is a listing of all ‘long-term’ Assets held by the business. These Assets include tangible personal property, tangible real property and intangible property. The FAR is used to understand what Assets are owned by the hotel, and their value, for financial & non-financial reporting, tax reporting, insurance coverage and repair regulation compliance to name a few of its uses.

Keeping in-mind that the Assets, when the hotel was acquired, were not acquired in ‘new condition,’ but acquired in a ‘used condition.’ It would be improper to book the value of those Assets on the FAR as ‘New’. Depreciation must be accounted for on the FAR as it is developed. Depreciation is accounted for in the form of a) Physical Depreciation b) Functional Obsolescence and c) Economic Obsolescence.

In-short:

A team of Licensed and/or Accredited Team of Professionals will inventory and analyze the Assets that will be posted to the FAR. Assigning fair, and reasonable, depreciation & obsolescence factors to each Asset. Our team is normally made-up of a Business Valuation Appraiser, Commercial Real Property Appraiser, Machinery & Equipment Appraiser, and Cost Segregation Professional.

- Business Valuation Appraiser – Measures Depreciation/Obsolescence of Intangible Property. This property includes, but is not limited to, contracts, franchise agreements, reservation systems, workforce, debt servicing, and goodwill.

- Commercial Real Property Appraiser – Measures Depreciation/Obsolescence of Tangible Real Property. This property includes the underlying land value, building & structure value(s), and site improvement values.

- Machinery & Equipment Appraiser – Measures Depreciation/Obsolescence of Tangible Personal Property. This Property includes, but is not limited to, Furniture, Fixtures, Equipment found in the hotel setting.

- Cost Segregation Professional – A Non-Appraisal Tax Professional, who works with the Commercial Real Property and Machinery & Equipment Appraisers, for the Purpose of producing a quality tax saving federal & state income tax depreciation study.

- Other Appraisers (as needed) – The Machinery & Equipment Appraiser will call into the assignment, if needed, Personal Property Appraisers with specific knowledge/expertise in Fine Art, Fine Furniture, Gems & Jewelry and Aircraft.

Measurements of Depreciation:

- Physical Depreciation – Physical deterioration of an Asset over time or by use.

- Functional Obsolescence – Functional capacity as measured by current market standards.

- Economic Obsolescence – External depreciable factors not related to Physical Depreciation or Functional Obsolescence of the Property.

The Process for Fixed-Asset-Record Development:

During our site visit, to set-up the FAR, our team of Real Property, Machinery & Equipment and Cost Segregation Professionals will perform a detailed inventory of all Tangible Property (Real & Personal Property), which will be posted on the FAR, with notes as to the physical condition of the property; to later assist in the proper appraisal/valuation of that Tangible Property. All three Professionals are constantly communicating with each other, on who will be valuing each category of Property. Such questions as: “Who will value the chandlers, window treatments, and/or cabinetry?” and/or “What property should be classified as ‘Real’ or ‘Personal’ Property?” This communication ensures that Property is only captured once on the FAR and not accidentally captured multiple times.

While our Real Property, Cost Segregation, and Machinery & Equipment Professionals are in the field inventorying the Tangible Property; our Business Valuation Professional is reviewing contracts, agreements, and accounting ledgers to understand the intangible value of the business. This review is made with the assistance of Ownership, Management, and Staff.

Once the site visit is complete, the challenging work begins, with our Real Property and Machinery & Equipment Appraisers, conducting independent valuations using the inventory of Assets they recorded during their site visit(s). Those Assets will then be analyzed, applying the proper depreciation / obsolesce factors, to conclude ‘Fair Market Value’ of each Asset, which will be posted to the FAR. Handing off their Real & Personal Property Valuations to the Business Valuation Professional, those conclusions of Fair Market Value will be incorporated into the Intangible Valuation of our Business Valuation Professional, giving a full accounting of value to Hotel Ownership & Management.

Once the value conclusions are approved, by Management and Ownership, it is time for our Cost Segregation Professional to begin his/her work by focusing on the two (2) key primary conclusions of depreciable real property value: the structure and site improvement values, as provided by the Commercial Real Property Appraiser. These two values are currently captured on the FAR and/or Income Tax Ledger as 39-year depreciable tax lived property, while the underlying land value will be given a zero (0) depreciable life as land is never depreciable.

As land is never depreciable, land will remain on the FAR/Tax Ledger, as a non-depreciable Asset, but many of the depreciable real property Assets, categorized as structures and site Improvements, can be reassigned short tax lives of 5 or 15-years. In short, Real Property that is ‘Considered Personal Property’ or that ‘Directly Supports Personal Property,’ may be reclassified as ‘short-lived depreciable property’. Our Cost Segregation Professional does not create depreciation, but rather, reclassifies long-lived 39-year tax depreciable property to shorter-lived 5 or 15-year tax depreciable property. The reason for this reclassification from long-lived to short-lived property is three-fold: a) Ownership Time Horizon – we don’t know how long a Property will be owned by the new owner(s), but we know they own the property today, thus it is advantageous to receive the highest federal & state income tax deduction allowed by law (tax obversion). b) Inflation – we want our tax deduction today, when the dollar ($) has the highest buying power, and not a devalued inflationary dollar ($), in the future. c) Reinvestment Opportunity – we want our tax deduction today, so that those deducted dollars ($) may be reinvested into the business. This ‘Reinvestment Opportunity’ can ‘be measured using a Net-Present-Value Tax Savings/Time Value of Money calculation (demonstrated later in this article).

Our Cost Segregation Professional using their site visit notes, with guidance from the commercial real property appraiser and report, will take their working inventory, collected during the site visit, which contains hundreds, or thousands, of real property Assets entries; and calculates the Replacement Cost New for each Real Property Asset. Then using guidance from the commercial real property report, calculates the Replacement Cost New Less Depreciation (‘RCNLD’) of those Assets. Those depreciated costs will then be reconciled to the commercial real property report conclusions ($), using a Prorata formula, which will adjust our RCNLD up, or down, to the value conclusion ($) found on the Commercial Real Property Valuation Report.

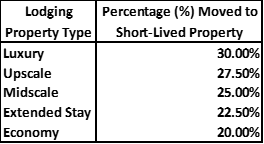

The amount ($) moved from long-lived 39-year Property to short-lived 5 & 15-year Property will vary from Industry to Industry and Property to Property. The lodging industries ‘short-lived allocation normally falls in the 20% to 30% range for interior improvements. As the guest amenities increase, at each property type, the greater the percentage (%) we would expect to be reclassified from long-lived to short-lived Property. This of course, is a ‘general rule,’ understanding that each lodging property is unique.

Rule-of-Thumb:

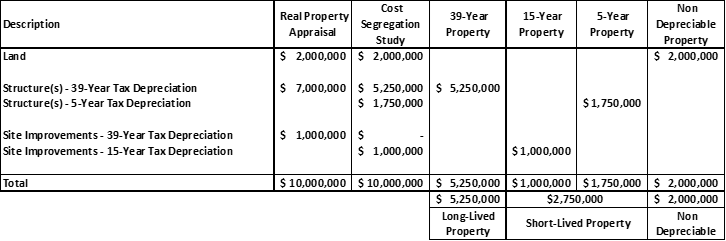

The following table shows the anticipated reclassification of a ‘Midscale Hotel, where 25% of interior improvements have been reclassified from long-lived 39-year property to short-lived 5-year property, and 100% of exterior site improvements, being reclassified from long-lived 39-year property to short-lived 15-year property.

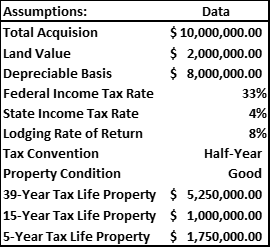

As the table (above) shows, a reclassification of $2,750,000 from long-lived 39-year property, to short-lived 5 & 15-year property has been achieved. Intuitively, we can see how this shift from long-lived to short-lived property is a benefit with an unknown Ownership Time Horizon and an inflationary tool to defend against the inflationary dollar ($), but as mentioned above, we can measure the benefit/tax savings, using a simple Net-Present-Value Tax Savings/Time Value of Money Calculation. Using some accepted hospitality accounting/tax assumptions, we can calculate the Net Present Value Tax Savings for the above $10 million dollar lodging acquisition:

Net-Present Value Tax Savings= $217,493

The Net-Present Value Tax Savings of $217.493 is the minimum tax savings that would be realized. Additional savings can be realized with the use of first year ‘bonus depreciation’,’ which will add additional benefit, a subject we will discussed in future articles.

It is clear, that a quality Cost Segregation Study, in conjunction with a Fixed-Asset-Record Development Study, is The Trifecta of Lodging Acquisitions Studies. The Net-Present Value Tax Savings, realized from a quality cost segregation study, will more than pay for the needed valuations and FAR study needed for your newly acquired lodging property.

About the author

Walter O’Connell, Managing Director of Hotel Valuation & Cost Segregation Services, LLC (HVCSS) and a consultant at Cayuga Hospitality Consultants. Responsible for a variety of valuation services which include the valuation of tangible assets for purchase price allocation, financing, tax depreciation, insurance, and cost segregation studies. Walt has extensive experience in Furniture, Fixture & Equipment valuation (FF&E) and Cost Segregation Studies within the hospitality industry. Walter holds a Bachelor of Arts degree in Economics and Bachelor of Science degree in Finance from Kean University of New Jersey and a Master of Arts degree in Economics from Montclair State University of New Jersey. Walt continues to strengthen his credentialing by not only taking, but also teaching, technical courses in the fields of Personal Property Valuation and Cost Segregation.

Contact Us