Not All Short-Lived Depreciable Property is Captured in a Cost Segregation Study

Personal Property Appraisal & Cost Segregation Studies – Powerful Tools!

Congratulations! You have acquired your #hotel, #motel or #resort. Now it is time for your accounting team to get to work. It has been 26 years since the landmark ruling: ‘Hospital Corporation of America [HCA] vs. Commissioner, 109 TC 21 (1997)’. It is now settled law, with the IRS issuing their first ‘Cost Segregation Audit Techniques Guide’ in 2004.

Your accounting staff, whether in-house or an outside CPA, are sophisticated, and understand the federal and state income tax advantages of reclassifying long-lived 39-year depreciable property to 5 & 15-year depreciable property. They understand:

a) Ownership Time Horizon. The implication of this is that the current owners may not own the property for a full 39 years and want to take advantage of increased cost flow in the immediate future.

b) Inflation. Inflation eats into the futures value of tax credits, so many owners will want to take advantage of increased cash flow due to the effects of inflation.

c) Reinvestment Opportunity. By accelerating taxable depreciation, ownership can reinvest that increased cash flow into future projects.

But a Quality Cost Segregation does not capture all short-lived property. A Cost Segregation Study is designed to reclassify commercial real property that is either considered personal property or directly supports personal property from 39-year long-lived tax depreciable property to 5 & 15-year short-lived tax depreciable property.

A Cost Segregation Study is not designed to capture, or properly depreciate, Movable Personal Property not associated with Real Property.

Personal Property Appraisal of Furniture, Fixtures & Equipment

The reason for the exclusion of Movable Personal Property from the Cost Segregation analysis is two-fold. First, Furniture, Fixtures & Equipment (‘FF&E’) are not attached and/or associated with real property. Second, most Cost Segregation Professional are not Accredited Personal Property Appraisers with the knowledge and skill set to opine on the value of personal property. Cost Segregation Professionals do not opine on value, even real property value, but rather reclassify the tax lives based on a real property appraisal and/or purchase price provided by ownership/management.

The Problem

Smaller lodging properties often simply allocate the total purchase price of the property to real property and ignore the Movable Personal Property on-site. This has a negative effect on cash flow, as it overinflates the long-lived 39-year property reported on federal and state income taxes.

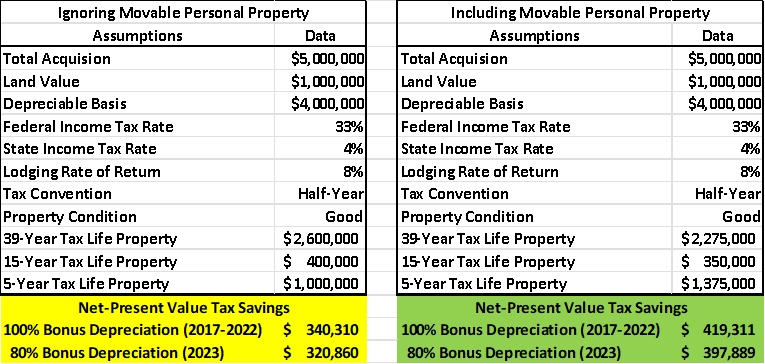

As the charts above show, if we were to identify $500,000 in Movable Personal Property and move that property out of Real Property and into short-lived Movable Personal Property, our short-lived property moves from $1,400,000 (5 & 15-Year Property) to $1,725,000 (5 & 15-Year Property). Also, long-lived 39-year property has now been reduced from $2,600,000 to $2,275,000.

The tax savings from this shift from long-lived property to short-lived property, can be measured using a ‘Net-Present Value Tax Saving’ formula.

The cost/value of short-lived ‘real’ property and short-lived ‘movable’ property will vary from lodging property to lodging property, but what this demonstrates is the strategic tax savings advantages of performing a personal property valuation, in conjunction with a quality cost segregation study.

100% Bonus Depreciation (2017-2022) $340,310 vs. $419,311

80% Bonus Depreciation (2023) $320,860 vs. $397,889

Selecting a firm that can meet both your personal property valuation needs and cost segregation needs will optimizes your tax savings goals.

About the author

Walter O’Connell, Managing Director of Hotel Valuation & Cost Segregation Services, LLC (HVCSS) and a consultant at Cayuga Hospitality Consultants. Responsible for a variety of valuation services which include the valuation of tangible assets for purchase price allocation, financing, tax depreciation, insurance, and cost segregation studies. Walt has extensive experience in Furniture, Fixture & Equipment valuation (FF&E) and Cost Segregation Studies within the hospitality industry. Walter holds a Bachelor of Arts degree in Economics and Bachelor of Science degree in Finance from Kean University of New Jersey and a Master of Arts degree in Economics from Montclair State University of New Jersey. Walt continues to strengthen his credentialing by not only taking, but also teaching, technical courses in the fields of Personal Property Valuation and Cost Segregation.

Contact Us